Traders could have used the breakout to potentially enter long positions and/or get out of short positions. If entering long, a stop loss would be placed just below the resistance level of the triangle (or even below triangle support). Because the price had a large gaping breakout, this stop loss location may not be ideal. After the price continued to move higher following the breakout the stop loss could be trailed up in order to reduce risk or lock in a profit. This flurry of activity will often cause volume to rise, which shows lots of traders were interested in the breakout level. If there is little volume on the breakout, the level may not have been significant to a lot of traders, or not enough traders felt convicted to place a trade near the level yet.

This can help you gain experience and confidence, and learn from your mistakes and successes. You can also use a journal or a tracker to record your trades and results, and analyze your performance and improvement. Boeing is edging lower today as the market seems to be settling inside a symmetrical triangle. This is a very common pattern in technical analysis with a rather low market performance when confirmed. However, theory states that usually the breakout follows the underlying medium-term trend, which in our case is bullish and has been since the double-bottom pattern formed during 2022. Breakouts then occur when there is a change in the supply and demand of a stock.

How to Trade Breakout or Fake out Using Trading Indicators?

Traders can confirm them by using volume, lower time frames or retests to avoid surprises. Now that we know what to look for, we can use these signals to confirm trade ideas. If trader Fred already has a bearish outlook, he can look for a false breakout to enter his trade and add more confidence to his already bearish thesis. Pay attention to the line drawn from the signal of the Stacked Imbalances indicator (marked with a dotted line). This can serve as a guideline for setting stop-losses or entering a position when testing this level.

- The support and resistance levels and the chart patterns that provide the basis for the breakouts might be interpreted differently by different traders.

- In the below chart, the Euro 50 index tried three times to climb above the trendline resistance area.

- In fact, false breakouts are often engineered to look like the real deal to lure traders into taking wrong positions.

- Breakouts are generally preceded by a period of low volatility, where the price is contained by resistance, support, or both.

- The trading range tends to have a defined support and resistance level that can be identified with various chart indicators including trendlines and moving averages.

However, using heikin ashi for breakout trading is not without its challenges and risks. In this article, you will learn what are the common pitfalls and mistakes to avoid when using heikin ashi for breakout trading, and how to improve your chances of success. Suppose that in the market, the forces of buyers and sellers were balancing each other out for a period of time. At the same time, the price was forming a trading range (was flat). The boundaries of a formed range (or a technical analysis pattern) usually define support and resistance levels.

A market maker or professional trader may regularly short a stock at the resistance area and buy at the support area almost like clockwork in a defined range. The longer this range holds, you can also assume more and more participants are doing the same thing as transparency becomes too obvious. What happens to the short-sellers when the price initial spikes above the resistance area? Anticipating a price drop, they leverage more shorts building up a larger position than normal.

If it moves just above and then the candle closes below the breakout point, this is not as effective as a stock that surged and closed the period well above the breakout point. A decisive breakout is more likely to follow through in the expected breakout direction. Once the share price is near the prior high, if the price swings start to get smaller and smaller, this means that the size of the price movement is contracting. You can draw trendlines on the swing highs and lows of these price swings, in order to see the handle of the cup, using the drawing tools on our advanced online trading platform.

The Emergence of Bullish Structure in QQQM

Get tight spreads, no hidden fees and access to 12,000 instruments. The IBD Breakout Stocks Index has more than doubled the performance of the S&P 500 (total return, including dividends) when backtesting its performance to Oct. 12, 2010. The average annual gain for the IBD Breakout Stocks Index has been 25.88%, compared to 9.65% for the S&P 500. Here is a simplified illustration of the different participants that join the action when a breakout forms. After a trade fails, it is important to exit the trade quickly.

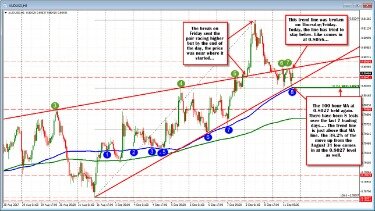

AUD/USD Forex Signal: False Breakout Points to More Downside – DailyForex.com

AUD/USD Forex Signal: False Breakout Points to More Downside.

Posted: Mon, 15 May 2023 08:37:26 GMT [source]

For instance, a stock will break a resistance level when there are more buyers than sellers at that particular time, whereas a support level will be broken when sellers outweigh buyers. Say a stock bumped up against a resistance level multiple times and then finally broke above it, but you did not spot it right away. Often, there will be a second chance to trade when the price falls back to re-test the breakout area. Assuming that the breakout had critical signals of an effective breakout, we can assume that that re-testing can be used to enter a trade.

A breakout occurs because the price has been contained below a resistance level or above a support level, potentially for some time. The resistance or support level becomes a line in the sand which many traders use to set entry points or stop loss levels. It is important to note that, similar to other methods in technical analysis, breakouts can be subjective. The support and resistance levels and the chart patterns that provide the basis for the breakouts might be interpreted differently by different traders. To use it effectively, you should watch out for certain signals and patterns that could indicate a potential breakout. Additionally, look for a continuation of the trend after the breakout with minimal pullbacks or corrections.

The bands are placed a specified number of standard deviations away from the 20-period moving average, which can be adjusted. Breakout trading offers this insight in a fairly clear manner. After a breakout, old resistance levels should act as new support and old support levels should act as new resistance. This is an important consideration because it is an objective way to determine when a trade has failed and an easy way to determine where to set your stop-loss order.

How to trade level breakouts without risks

Usually a breakout will re-test the resistance on a pullback for confirmation. If the price manages to stabilize above the prior resistance, then it becomes a new support level. A successful re-test of the new support instills confidence inviting more buyers into the stock to sustain the uptrend. Typically, the most explosive price movements are a result of channel breakouts and price pattern breakouts such as triangles, flags, or head and shoulders patterns.

This will help you validate and confirm the heikin ashi signals and filter out false or weak ones. Additionally, you should use heikin ashi on multiple time frames, such as daily, hourly, or 15-minute charts. This way you can identify the overall trend and the shorter-term fluctuations, and align your trades with the higher time frame direction. Lastly, remember to employ proper risk management and discipline when trading with heikin ashi, such as setting stop losses, trailing stops, profit targets, and position sizes. This will help you protect your capital and lock in your profits while avoiding being greedy or fearful. A breakout is a stock price moving outside a defined support or resistance level with increased volume.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform. A stop-loss order is generally placed at the lower Bollinger Band after entry. As the price increases, it is possible to move the stop loss up along with the lower Bollinger Band as well. With an entry near $105, this would have kept the trader in until $150, when the price touched the lower band.

Investors must exercise caution until $315 is decisively breached since this level is considered as the decision level for QQQ ETF. Before placing a trade, you must know what your entry, stop loss, and exit methods are in order to increase your chances of making a profit over time. A stop-loss can be placed placed below the handle, and you can estimate the target to get out at by taking the approximate height of the cup added to the handle breakout point.

Is breakout trading a good strategy?

For most novice traders, trading range breakouts will be a losing strategy. False breakouts will result in losses, corrections will fake traders out of legitimate moves, and explosive gains are rare considering the many potential ranges available to trade.

Stocks breakouts are considered a vast source of opportunity or risk in the market. When a breakout occurs, it may be the beginning of a strong trend. Breakouts can offer huge opportunities for massive profits because they allow traders to ride out a new trend from its very beginning.

How do you Analyse breakouts?

The first step in trading breakouts is to identify current price trend patterns along with support and resistance levels in order to plan possible entry and exit points. Once you've acted on a breakout strategy, know when to cut your losses and re-assess the situation if the breakout sputters.

Therefore, the key to determining a breakout stock is a market that is in a period of consolidation. It is a stock characterized by low volatility and will https://trading-market.org/ be contained by defined support and resistance levels. It can be contained in channels or even candlestick patterns, such as triangles, flags and wedges.

A 52-week high or low is simply the highest or lowest price seen over the last year. Even after a high volume breakout, the price will often (but not always) retrace to the breakout point before moving in the breakout direction again. This is because short-term traders will often buy the initial breakout, but then attempt to sell quite quickly for a profit. This selling temporarily drives the price back to the breakout point. If the breakout is legitimate (not a failure), then the price should move back in the breakout direction. While breakout trading can offer significant profits, achieving consistent success can be challenging due to false breakouts and missed opportunities.

- Suppose that in the market, the forces of buyers and sellers were balancing each other out for a period of time.

- On the other hand, a reversal happens when a stock has been trending in one direction and then enters a period of consolidation.

- Still, the return of high volatility in the market is denoted by the divergence of the upper and lower bands of the indicator.

- Breakouts occur when the price moves beyond a certain range or level, signaling a change in trend or momentum.

- If trader Fred already has a bearish outlook, he can look for a false breakout to enter his trade and add more confidence to his already bearish thesis.

- There are certain patterns that traders should recognise for their investment research if they wish to catch these potential stock breakouts early in the process.

In the case of going long on an upside breakout, a stop loss is typically placed just below the resistance level. In the case of going short on a downside breakout, a stop loss is typically placed just above the support level that has been breached. In short, a false breakout happens when the price breaks above or below a resistance level, trend line or area of interest, but then fails to hold breakout technical analysis it. This usually happens because either the area was not as significant as the trader thought or large players engineered the breakout to fill their orders. The model uses trendlines and

breakouts above resistance levels

to identify the start of a new trend. At some point, either through technical analysis, fundamental reports, or news events, the stock breaks free from the range.

Is breakout bullish or bearish?

A breakout is a bullish technical analysis term depicting a price move that exceeds a defined resistance level and proceeds to sustain higher prices until the next resistance level is formed.