Contents:

Investors use financial reports filed quarterly and annually by public companies to assess the companies’ financial health and spot trends in overall performance. Comparing Q/Q information among companies with different quarter start dates can distort an analysis due to seasonal factors or temporary environmental conditions. It can be applied to GDP, corporate revenue, or an investment portfolio. For example, ABC Company’s first-quarter earnings were $1.50 per share, and its second-quarter earnings were $1.75 per share.

Till now you might have got some idea about the acronym, abbreviation or meaning of QOQ. You might also like some similar terms related to QOQ to know more about it. This site contains various terms related to bank, Insurance companies, Automobiles, Finance, Mobile phones, software, computers,Travelling, School, Colleges, Studies, Health and other terms. This page is all about the meaning, abbreviation and acronym of QOQ explaining the definition or meaning and giving useful information of similar terms. Sometimes it’s useful to be able to calculate actual values primarily based on the proportion increase or lower. If you wish to calculate the share enhance or lower of a number of numbers then we suggest using the first formulation.

Tools for Measuring Your Marketing Campaigns

In the shoe store example, if you’re comparing boot sales between periods, it might look like your sales are doing much worse in the summer than in the winter. Comparing winter sales from different years will give you a better sense of how you’re doing. For example, conducting YOY over two years would be similar to conducting QOQ over eight quarters or MOM over 24 months. Longer time frames provide a holistic overview of performance, while shorter time frames demonstrate a better representation of the effects of events and seasonality.

National State of Disaster Declaration Highlights Credit Risks Facing … – Fitch Ratings

National State of Disaster Declaration Highlights Credit Risks Facing ….

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

Positive values point out a percentage increase whereas negative values point out share decrease. YTD monetary statements are routinely analyzed in opposition to historical YTD financial statements via the equal time period. By the middle of the fourth quarter of 2019, the annual knowledge for 2019 could be estimated by summarizing the last 4 quarters. Investors and analysts examine financial statements, which are released either yearly or quarterly, to assess the financial health of a company. The quarterly statements are publicly available through the EDGAR databaseprovided by the Securities and Exchange Commission or a company’s website, and are called 10-Q statements. Analysts look at Q/Q numbers and changes when reviewing a company’s performance over multiple quarterly periods.

Comparing Q/Q information among companies with totally different quarter begin dates can distort an evaluation—the time included may differ, and seasonal factors could become skewed. Sequential progress is the measure of a company’s monetary performance in a current interval in comparison with these of the interval instantly previous it. YOY is used to make comparisons between one time period and another that is one year earlier. This allows for an annualized comparison, say between third-quarter earnings this year vs. third-quarter earnings the year before.

Challenges with QOQ Analysis

Year to date refers to the period of time beginning the first day of the current calendar year or fiscal year up to the current date. YTD information is useful for analyzing business trends over time or comparing performance data to competitors or peers in the same industry. Companies, traders, and analysts use knowledge from completely different quarters to make comparisons and consider tendencies. For instance, it’s common for a corporation’s quarterly report back to be in comparison with the identical quarter the earlier 12 months. Many companies are seasonal which would make a comparison over sequential quarters deceptive.

- For relatively low growth rates, the annual rate of change is roughly equal to the sum of non-annualised quarterly growth rates over the last four quarters .

- The value from the current quarter can be called the Present Value, and the numbers from the previous quarter can be called the Past Value.

- Consider the scenario above comparing quarterly returns between two companies.

- Analysts look at Q/Q numbers and changes when reviewing a company’s performance over multiple quarterly periods.

Each launch has the potential to considerably affect the value of a company’s stock. If the company has a poor quarter the worth of its inventory might drop dramatically. However, it can be difficult or time-consuming to have to work out these figures every time on Excel.

YOY comparisons are a well-liked and efficient way to evaluate the monetary efficiency of an organization and the efficiency of investments. Any measurable occasion that repeats yearly can be compared on a YOY foundation. Common YOY comparisons embody annual, quarterly, and monthly performance. An financial development rate is the share change in the worth of all the goods and services produced in a nation throughout a specific period of time, as compared to an earlier period.

Shorter time frames, such as monthly, are valuable for analyzing data that are driven by short-term factors. Longer time frames like yearly are best suited for data-driven by long-term factors. Long-term metrics are less susceptible to fluctuations because it smooths out short-term deviations.

Words Starting With Q and Ending

This means that if the value in the base quarter is impacted due to some reason, then the Quarter-on-Quarter growth calculation could generate weird values. A major problem with the Quarter over Quarter growth is that the calculations could get biased in seasonal industries. For example, a hotel might have 100 % occupancy during the peak tourist season and during the off-season, the occupancy might just be 40 %, for example. “New Zealand third-quarter growth tempered by weak commodities, to keep central bank sidelined”.

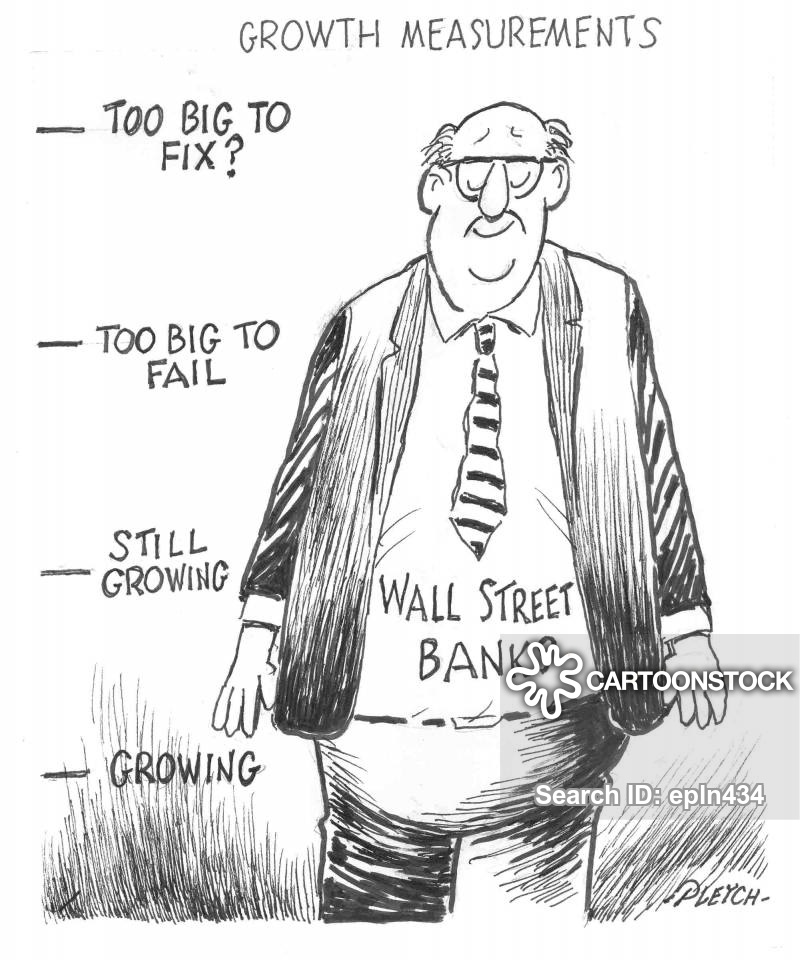

It is important for any investor to remove the effects of seasonality when they can when making comparisons of companies with different quarter start dates. The month over month measures growth over previous months but tends to be more volatile than Q/Q as the rate of change is affected by one-time events, such as natural disasters. The YOY measures changes in performance in one year over the previous year. YOY incorporates more data and thus provides a better long-term picture of the underlying report figure. The Q/Q rate of change is typically more volatile than the YOY measurement but less volatile than the M/M figure. It iscommonly used to determine a company’s performance or economic growth/decline.It also allows for investors to compare across different investments of various sizes.

Understanding Search Marketing SEO Vs SEM

If the number is negative, there has been quarter over quarter de-growth. Q/Q is also used to measure changes in other important statistics, such as gross domestic product . Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

YOY comparisons are popular when analyzing a company’s performance because they help mitigate seasonality, a factor that can influence most businesses. Sales, profits, and other financial metrics change during different periods of the year because most lines of business have a peak season and a low demand season. Comparing Q/Q information among companies with different quarter start dates can distort an analysis—the time included may vary, and seasonal factors may become skewed. An investor would have to consider several quarters over a period of time to determine whether changes reflect an ongoing trend or are impacted by external factors.

Quarter over quarter refers to the mathematical process of comparing one quarter of data to the previous quarter. In business, note that the start and end dates of quarters can vary, though they are generally three months, or 90 days, long. Some businesses also use compound monthly growth rate to show growth over a given number of months. CMGR can also be used to predict likely performance over the next few months.

Infosys Q3FY23: Know time, date, earnings details of third quarter. What to expect? Mint – Mint

Infosys Q3FY23: Know time, date, earnings details of third quarter. What to expect? Mint.

Posted: Sun, 08 Jan 2023 08:00:00 GMT [source]

That’s because it offers insights on a longer time period than other time-based metrics such as MTD. The same formula can also be used to calculate the YTD for sales, marketing campaigns, company costs, demand and supply, and many more. It is also a key metric in investing, where it is used to show the returns from an investment or portfolio. YTD reports are extremely valuable time-related calculations since they are directly indicative of current performance.

After the end of each quarter , a company will declare its financial results. Real gross domestic product is an inflation-adjusted measure of the value of all goods and services produced in an economy. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. The Structured Query Language comprises several different data types that allow it to store different types of information…

GDP quarterly national accounts, UK: July to September 2022 – Office for National Statistics

GDP quarterly national accounts, UK: July to September 2022.

Posted: Thu, 22 Dec 2022 08:00:00 GMT [source]

YOY comparisons are a popular and effective way to evaluate the financial performance of a company. For instance, within the third quarter of 2017, Barrick Gold Corporation reported a net lack of US$11 million, yr-over-12 months. You can compare the YTD returns of different shares to measure and rank their efficiency for the year. Percentage improve is useful if you need to analyse how a value has modified with time. Although percentage enhance is similar to absolute improve, the former is more helpful when comparing multiple knowledge units.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Making statements based on opinion; back them up with references or personal experience. Year-on-year changes are a great for time series plots, but you need to dig further if you want to discuss acceleration/deceleration. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. However, a closer look at the numbers will reveal that the PAT in quarter 3 is still lower than the PAT in quarter 1 .

Certain economic reports are released quarterly and compared to previous quarters to indicate economic growth or decline. Quarterly income development is an increase in a company’s gross sales when in comparison with a earlier quarter’s income performance. Often, the QOQ measure is used to compare the earnings between quarters.

The quarterly statements are publicly obtainable via the EDGAR database and are known as 10-Q statements. Analysts have a look at Q/Q efficiency when reviewing an organization’s efficiency over a number of quarterly durations. Other variations of the Q/Q are the month over month (M/M) and 12 months-over-12 months . The month over month measures development over earlier months but tends to be extra volatile than Q/Q as the speed of change is affected by one-time events, similar to pure disasters. The YOY reviews adjustments in efficiency in a single yr over the earlier yr.

- The change in the annual growth rate on quarter is therefore driven by the difference between the latest quarter, and the quarter that dropped out of the annual average.

- An investor would study several other quarters to see if these changes are a trend or simply seasonal or temporary adjustments.

- Investors use financial reports filed quarterly and annually by public companies to assess the companies’ financial health and spot trends in overall performance.

- Quarter-on-quarter or quarter-over-quarter is a term of art in accounting, finance and economics.

- Most financial reporting and dividend funds are accomplished on a quarterly foundation.

- Comparing to the previous period helps you look at the progress you’ve made towards your goals and adjust your methods accordingly.

We only need basic mathematics to measure the growth on a Quarter on Quarter basis. The value from the current quarter can be called the Present Value, and the numbers from the previous quarter can be called the Past Value. No matter how a stock is analyzed, quarter-over-quarter performance—or more accurately, a number of quarter-over-quarter assessments—is often vital information for investors. Plugging the numbers above into the formula for determining QOQ or YOY change, Airbnb revenue in Q2 this year grew 50% from Q1 this year and 300% from the second quarter of 2020. Of course, in the second quarter of that year, travel for Airbnb users was mostly suspended as the world went into lockdown. Investors typically review and compare performance from several quarters to assess the proper value of a company.

qoq meaning compares a change in performance between one fiscal quarter and the previous fiscal quarter. ClicData allows you to track all kinds of business metrics easily using our cloud-based web platform. Our visualization tools help you to pick out trends quickly, build visual KPIs, build custom dashboards, refresh data automatically, and more.

It gives a more accurate view of whether the numbers are growing or declining. A company had $110 million in revenue in 2018, compared to $100 million in 2017. In other words, revenue increased by $10 million compared to the previous year, which amounts to a 10% YoY revenue growth. Suppose that the sales of a company in Quarter 4 of this year is INR 6 crore and the sales in Quarter 3 of this year was INR 5 crore .

Dept. of Commerce, the real growth rate shown in Table 1.1.1 in an annualized statistic based on the estimate of the QoQ level change in the real/constant-dollar value of the economy. The quarterly performance of companies can be analyzed by using the QoQ in share market. Comparing the present quarter with the preceding quarter can give a good measurement of the relative growth of a company. In addition, the QoQ growth is also regularly tracked for large economic indicators in the country.