Contents

If you expect the markets to become more volatile, one option is to purchase straddles or strangles. However, when volatility is expected to grow, these become prohibitively expensive. A better strategy would be to buy futures on the VIX index itself, allowing you to profit from volatility without having to worry about the direction of market movement. Long-term investors are usually unconcerned by short-term volatility. However, institutional investors and proprietary desks have risk and MTM loss restrictions. When the VIX indicates that volatility is growing, they might raise their hedges in the form of puts to play the market both ways.

The VIX had remained in the low 20s in 2008 when we all knew that problems were quickly spinning out of control, the VIX spiked, correcting its previous assumption. However, it spiked far beyond reality fracking dictionary as panic drove option premiums into the stratosphere. The VIX suffered huge whipsaws in 2009, 2010, and 2011 trying to over compensate and find some realm of equilibrium between perception and math.

What is the CBOE Volatility Index (VIX)?

The VIX works by tracking the price of at-the-money SPX options with near-term expiration dates. This means it’s not a representation of the price of the underlying S&P 500 itself, but of the price traders are willing to buy and sell the S&P 500 at for the next month. The more dramatic the price swings in the value of SPX options, the higher the levels of market volatility and so the higher the VIX value. Such VIX-linked instruments allow pure volatility exposure and have created a new asset class. As the range of strike prices for puts and calls on the S&P 500 increases, it indicates that the investors placing the options trades are predicting some price movement up or down.

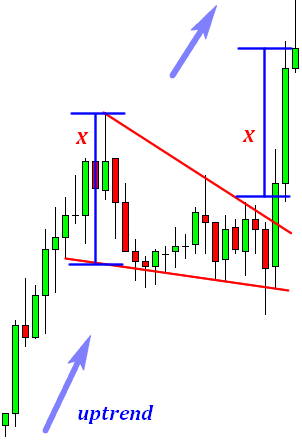

This provides a dynamic approach to position-sizing when trading the S&P 500 for more consistent results. This strategy is typically best employed when the VIX ‘signal’ arrives within the context of a generally bullish trend in the S&P 500. The S&P 500 VIX correlation is simply how the S&P 500 and the VIX move relative to one another.

So far this month, including Tuesday’s provisional data, FPIs have purchased shares worth nearly ₹29,284 crore in the cash segment, the best in three months. When the VIX and S&P 500 both rise together over a period of time it can indicate growing instability in the trend which sets the market up for a sell-off. The tighter relationship could very well be attributed to the various products introduced over the past years which allow market participants to trade the VIX. As said earlier, this would also make sense as to why we are also seeing larger spikes in the VIX when the market weakens, as trading of the VIX itself is causing exaggerated moves in implied volatility.

In a nutshell, the VIX is calculated by the Chicago Board of Options Exchange using market prices of S&P 500 put and call options with an average expiration of 30 days. It uses standard weekly SPX options and those with Friday expirations, but unlike the S&P 500 index, which contains specific stocks, the VIX is made up of a constantly changing portfolio of SPX options. The Chicago Board of Options website goes into more detail about its methodology and selection criteria. The VIX is an index created by Cboe Global Markets in 1993 that tracks how volatile the United States stock market is and is expected to be over the immediate future. It is widely used across the world as a measure of stock market volatility, with higher levels in the VIX indicating more volatility. It is a good indicator of the expectation of market volatility, note I said “expectation”, it is not representative of the actual volatility or what will happen.

How Do I Trade the VIX? Can You Buy Options on the VIX?

These SPX options with Friday expirations are weighted to yield a constant maturity 30-day measure of the expected volatility of the S&P 500 Index. In 2014, the VIX was enhanced once again to include a series of SPX Weeklys. A third of all SPX options traded are Weeklys, at close to 350k contracts a day.

For instance, imagine you hold a long position in the S&P 500-listed US firm stock. Despite your belief in its long-term potential, you’d want to limit your exposure to any potential volatility in the stock price in the near term. Because you believe volatility will rise, you establish a trade to purchase the VIX index. If you do this, you may achieve a sense of equilibrium between the two sides. The substantial negative connection between VIX-linked products and the stock market has gained enormous popularity as an alternative for diversifying and hedging and plain speculation amongst professional investors. In the realm of trading and investing, it is a critical index since it gives a measurable indicator of market risk and investor emotion.

Some individual investors may want to invest directly in the VIX. While you can’t buy shares in the index, you can invest in VIX derivatives or even exchange traded products that track the VIX. Like other indexes, which track the performance of a basket of stocks or other securities, the VIX measures volatility by tracking a basket of securities. The VIX tracks call and put options on the S&P 500 with expiration dates 30 days from the current date. When trading the S&P 500 there should be an inverse relationship between trading size and market volatility, or the VIX. One common mistake traders make is that they will simply trade a fixed lot size regardless of the distance their stop-loss is away from the entry price.

To view the VIX’s current reading, visit the webpage maintained by the Chicago Board of Options Exchange; it is updated daily. Analysts also believe that had data collection begun in the 1980s, the VIX would have topped 100 during the Black Stock Market Crash, on Monday, October 19, 1987. On October 24, 2008, at the height of the Financial Crisis, which stemmed from the global implosion of mortgage-backed securities, the VIX reached 89.53.

She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. NerdWallet strives to keep its information https://1investing.in/ accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Then grab several months of price data and calculate the monthly standard deviation in excel. In a second column, get several months of VIX values and compare the volatility of your stock to the VIX. The simplest way is as an indicator for future market movements as a whole. Because the VIX tends to track investor sentiment, you may be able to identify future rises and falls in the market as a whole based on movements in the VIX. If you’re confident that market volatility and investor fear are going to increase, the VIX gives you a way to profit from that prediction. It can be difficult to invest in a way that will help you turn a profit from volatility without using securities and derivatives based on the VIX.

What is Market Volatility?

We believe everyone should be able to make financial decisions with confidence. I am an experienced Binary Options trader for more than 10 years. The VIX index is a useful asset for portfolio managers and mutual fund managers.

- TJ Porter has over seven years of experience writing about investing, stocks, ETFs, banking, credit, and more.

- Therefore, these reflect constantly changing portfolios of SPX options.

- Experience our FOREX.com trading platform for 90 days, risk-free.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Alternatively, you could practise trading the VIX in a risk-free environment first, using our demo account. When the VIX goes up in value, it means the price of S&P 500 is likely falling and the value of SPX put options are increasing. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs.

Thus, vix helps in reducing the possibility of the risk with life insurance and such should be bought when investors consider the market downside to being generally low. Cboe-traded standard SPX options are used to calculate the VIx prices. This index expires every month on the second last or third Friday.

India VIX – India Volatility Index (NSE)

The Chicago Board of Options Exchange invented the VIX, a real-time volatility measure. To measure market volatility, it was used as the initial standard metric. However, since it is a forward-looking index, the S&P 500 anticipated volatility for the upcoming 30 days’ projection. The VIX is an index that measures the expected volatility of the stock market. Investors who want to use the VIX as a hedge can buy call options or sell put options against the VIX.

Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. Experts understand what the VIX is telling them through the lens of mean reversion. In finance, mean reversion is a key principle that suggests asset prices generally remain close to their long-term averages. If prices gain a great deal very quickly, or fall very far, very rapidly, the principle of mean reversion suggests they should snap back to their long-term average before long. Experience our FOREX.com trading platform for 90 days, risk-free. Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

The Cboe Volatility Index, or VIX, is a benchmark used to measure the expected future volatility of the S&P 500 index. Binary Options, CFDs, and Forex trading involves high-risk trading. In some countries, it is not allowed to use or is only available for professional traders. Because of this, you may be able to offset some of your losses from your VIX strategy with profits from your current trade.

If the market drops, the VIX is likely to rise, letting the investor profit from the options, recouping some of their investment losses. It is important when trading VIX products that one understands its inverse relationship to the equity markets. The VIX will usually rise in value as the stock market (primarily the S&P index) declines. For those interested in what the number mathematically represents, here it is in the most simple of terms. The VIX represents the S&P 500 index +/- percentage move, annualized for one standard deviation.

How Can You Invest in the VIX?

This update ensured a new level of precision in matching the 30-day timeframe the VIX represents. It gives investors an indication of volatility expectations in the market for the coming 30 days. Following the popularity of the VIX, the Cboe now offers several other variants for measuring broad market volatility. Examples include the Cboe Short-Term Volatility Index , which reflects the nine-day expected volatility of the S&P 500 Index; the Cboe S&P Month Volatility Index ; and the Cboe S&P Month Volatility Index .

So, if the big firms on Wall Street are anticipating an upswing or downswing in the broader market, they may try to hedge against that volatility by placing options trades. If many of the large investment firms are anticipating the same thing, there is usually a spike in options trading for the S&P 500. The VIX index uses the bid/ask prices of options trading for the S&P 500 index in order to gauge investor sentiment for the larger financial market. The India VIX is a volatility index calculated by the NSE from the order book of NIFTY options. The best bid-ask quotes of near and next-month NIFTY options contracts traded on the NSE’s F&O segment are used for this.

When the S&P 500 rallies we see demand for protection dissipate and as a result a decline in the VIX. Implied Volatility is the volatility implied by the market value of the options contract based on options pricing model. The below calculator is based on the Black Scholes european options pricing model. This calculator is appropriate for calculating implied volatility of the nifty options.